US Dollar Overview

The official currency of the United States is the United States Dollar (USD), identified by the ISO code USD and commonly abbreviated as US$. It is widely acknowledged as a standard currency, extensively employed in global transactions, and frequently adopted as the primary currency in various regions outside the U.S., such as Panama and Ecuador. Furthermore, certain nations unofficially employ the USD alongside their domestic currencies.

US Dollar Currency Facts

| US Dollar Stats | USD Profile |

| Name: | US Dollar |

| Nickname: | Greenback, Buck, Green, Dough, Smacker, Bones, Dead Presidents, Scrillas, Paper |

| Symbol: | $, US$, U$ |

| Date of Introduction: | April 2, 1792; 231 years ago |

| U.S. Currency in Circulation: | $1.54 trillion |

| Banknotes: | Freq Used: $1, $5, $10, $20, $50, $100 Rarely Used: $2, $500, $1000, $5000, $10,000 |

| Dollar Notes Made of: | 75% cotton and 25% linen blend, patented by Crane & Co. |

| Current US dollar Coins: | Five different denominations which have been nicknamed as: One cent: a penny Five cents: a nickel Ten cents: a dime Twenty-five cents: quarter Fifty cents: half a dollar |

| Dollar Coins Made of: | Metals such as nickel, copper, and zinc |

| Countries using US Dollar | The United States of America, the Marshall Islands, Micronesia, Palau, Ecuador, El Salvador, East Timor, and Zimbabwe |

History of the US Dollar

The history of the United States Dollar unfolds with a rich narrative that reflects the economic development of the nation and its responses to diverse challenges.

1. Early Colonial Period (Before 1775):

In the period preceding 1775, early American colonists utilized diverse currencies, including English, Spanish, and French money, while under English rule. However, with the commencement of the Revolutionary War in 1775, the Continental Congress found it necessary to create its currency, known as "Continental Currency." Unfortunately, the currency lost value, leading to the saying that it was "not worth a Continental."

2. Post-Revolutionary War and Mint Act of 1792:

After the Revolutionary War, the United States Constitution was officially approved, and in 1792, Congress passed the Mint Act, setting up the country's coinage system. The dollar was chosen as the primary form of currency, making the U.S. the world's first nation to use the decimal system for money. The initial U.S. coins were minted in 1793, with Martha Washington being the recipient of the first set of coins.

3. Paper Money and Private Bank Notes (1793 - 1861):

Though the government did not begin issuing paper money until 1861, instances of issuing "Treasury notes" occurred during financial crises. Concurrently, private banks, authorized under state charters, were permitted to print and use their paper money. Over 1,600 private banks generated approximately 7,000 variations of "state bank notes" during this period.

4. Civil War and the Introduction of Greenbacks (1861 - 1862):

With the onset of the Civil War and the urgent need for funds, the Act of July 17, 1861, enabled the Treasury Department to print and circulate paper money, known as "demand notes" or "greenbacks." Subsequently, these were replaced by United States notes, also termed legal tender notes.

5. Silver Certificates and National Bank Notes (1863 - 1929):

From 1863 to 1929, "silver certificates" were issued following the Congressional Acts of 1878 and 1886. The government exchanged these certificates for silver dollars, addressing the unpopularity of the large and heavy silver coins. Concurrently, numerous banks, as permitted by the National Banks Acts of 1863 and 1864, were authorized to issue their money known as "national bank notes."

6. Federal Reserve System (1913 - Present):

In 1913, Congress passed the Federal Reserve Act, establishing the Federal Reserve System. This authorized Federal Reserve Banks to issue Federal Reserve Bank notes. In 1914, the Federal Reserve Banks began issuing Federal Reserve notes, which are still in production today by the Bureau of Engraving and Printing.

Significance of the US Dollar

Since the conclusion of World War II, the dollar has maintained an unparalleled position as the world's primary medium of exchange. It serves as the most widely held reserve currency and is extensively utilized in international trade and various transactions globally. The dollar's significance in the global economy imparts several advantages to the United States, thereby extending the impact of U.S. financial sanctions.

The enduring stability of the dollar's value has consistently been an attractive feature. Owing to the significant importance and trust in this currency, there is universal recognition of U.S. dollars as legal tender. Additionally, numerous countries hold U.S. dollars in reserves to fortify the stability of their economies. An illustration of the considerable significance of the U.S. dollar is evident in the global oil market, where prices are consistently denominated in dollars per barrel, commonly referred to as petrodollars.

Current United States Dollar Notes & Coins

1. The currently circulated U.S. banknotes include denominations of $1, $2, $5, $10, $20, $50, and $100. In 1946, the printing of notes with values higher than $100 ceased, and their official circulation was halted in 1969.

2. President Richard Nixon took legislative measures to discontinue the printing of large denominations due to their increasing use by criminal organizations and the rising popularity of electronic banking.

3. While the predominant color remains green, the post-2004 series incorporates additional colors to distinguish between different denominations.

4. In 2008, the Bureau of Engraving and Printing planned to introduce an improved tactile feature in the subsequent redesigns of each dollar, excluding the $1 and the new edition of the $100 bill.

5. The plan also included larger, higher-contrast numerals, more color variations, and the provision of currency readers to assist visually impaired individuals.

6. For coins, the United States issues various denominations, with common ones being 1 cent, 5 cents, 10 cents, 25 cents, and 50 cents.

7. The U.S. Mint produces and distributes coins for transactions and also issues collectible and commemorative coins for auction, often honoring individuals, events, or places.

8. The volume of money in circulation is influenced by the actions of the Federal Reserve System. The Federal Open Market Committee (FOMC), consisting of 12 members, meets eight times annually to assess U.S. monetary policy.

9. If the Federal Reserve aims to increase the money supply, it acquires securities from banks in exchange for dollars. Conversely, to reduce the circulation of dollars, it sells securities to the banks.

How to Spot Counterfeit US Dollar Notes?

To identify counterfeit US Dollar notes, several key features can be taken into account. First, holding the bill up to the light reveals a color-shifting ink in the bottom-right corner of a genuine note. Additionally, an authentic watermark should be visible when the bill is held to the light, typically located on the right side. Genuine US Dollar bills also feature raised printing, a key element absent in counterfeits.

Be wary of any blurred printing or text, as this is an indicative sign of counterfeit notes. Another crucial feature is the security thread with microprinting, which is present in genuine notes but absent in fake ones. Lastly, authentic US Dollar bills have micro red and blue threads woven into the notes, a detail often lacking in counterfeit currency.

How Do We Measure The Value Of USD?

The value of USD is measured with the help of the US Dollar Index. It assesses the dollar's value against a basket of six foreign currencies, namely the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

A rising index signifies a stronger dollar against the basket, while a declining index indicates a weaker dollar in comparison. This index is like a dependable guide that tells us how the dollar is holding up in the worldwide market.

What is the US Dollar Index (USDX)?

The U.S. Dollar Index (USDX) serves as a measure of the U.S. dollar's value against a basket of foreign currencies. It originated in 1973 after the Bretton Woods Agreement dissolved and USDX was finally established by the U.S. Federal Reserve. Currently, ICE Data Indices, a subsidiary of the Intercontinental Exchange (ICE), manages it.

Here are a few key points about the US Dollar Index:

1. The USDX has seen significant fluctuations since its inception, reaching its peak in 1984 at nearly 165 and hitting an all-time low of almost 70 in 2007.

2. In recent years, the index has demonstrated relative stability, fluctuating between 90 and 110.

3. The index is influenced by various macroeconomic factors, including inflation/deflation in both the U.S. dollar and the foreign currencies within the basket.

4. Additionally, the economic conditions such as recessions and growth in the countries represented in the index contribute to its dynamics.

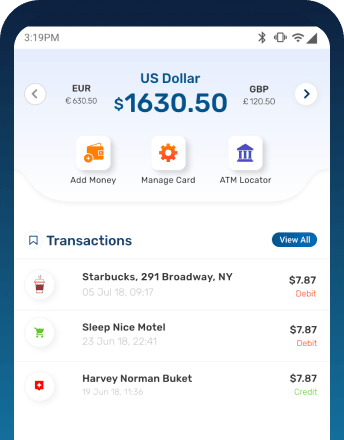

Benefits of buying/selling USD from BookMyForex

You can buy or sell USD online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent USD rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling USD :

1. BookMyForex offers the best rate for USD to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of USD currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%