What is a SWIFT/BIC code?

The SWIFT code, also known as a BIC number, is a standardized format for Business Identifier Codes (BICs). It serves as a means of identifying banks and financial institutions around the world. To put it simply, it is a type of international code or ID that specifies the name and location of the bank/institution.

The codes are used to transfer money between banks, particularly when sending international wire transfers or making SEPA payments. These codes are also used by banks to exchange messages between themselves.

Understanding Format of a SWIFT/BIC code

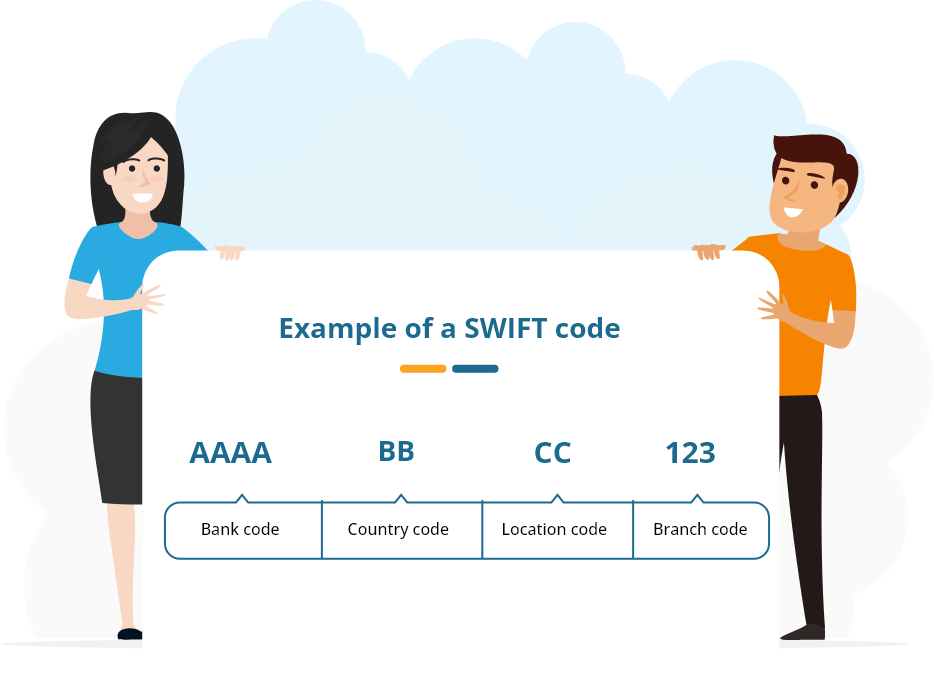

A SWIFT/BIC code consists of eight to eleven characters that represent the country, city, bank, and branch

- A bank's name is represented by 4 letters. In most cases, it looks like the shortened name of that bank.

- The country in which the bank is located is represented by two letters.

- 2 characters made up of letters or numbers. It says where that bank's head office is.

- A branch is identified by three digits. A bank's head office is represented by 'XXX'.