Euro Currency Profile

The Euro, denoted by the symbol €, is the official currency and monetary unit of the European Union. Its inception traces back to 1999 when it was initially introduced as a noncash monetary unit. Subsequently, in 2002, physical currency in the form of coins and notes was officially issued, marking a significant milestone in the integration of the European financial landscape. A unified currency system was implemented to replace the individual national currencies of participating European Union member states, streamlining financial transactions and fostering economic cohesion within the region. The Euro's adoption extended beyond EU borders, with some non-EU countries also choosing to adopt this common currency.

Euro Currency Facts

| EUR Stats | EUR Profile |

| Name: | EURO |

| Nickname: | EUR |

| Symbol: | € |

| Date of Introduction: | January 1, 1999; 24 years ago |

| EURO Currency in Circulation: | €2,211 billion |

| Banknotes: | Frequently Used: €5, €10, €20, €50, €100 Rarely Used: €200, €500 |

| EURO Notes Made of:: | Cotton fibers |

| Current EURO Coins: | €2, €1, 50c, 20c, 10c, 5c, 2c and 1c |

| EURO Coins Made of: | Metal alloys such as nickel, copper, and zinc |

| Countries using EURO | 20 out of 27 EU member countries, collectively known as the euro area, use the euro (€) as their official currency |

History of the Euro

The history of the Euro reflects a journey marked by challenges and strategic decisions, leading to the establishment of the Eurozone and the widespread adoption of the Euro as a common currency across participating European nations.

1. Economic and Monetary Union (EMU):

The concept of an Economic and Monetary Union (EMU) within the European Union emerged in the late 1960s. EMU involved the coordination of economic and fiscal policies, a common monetary policy, and the introduction of a shared currency, ultimately becoming the Euro.

2. Multiple Challenges and Obstacles:

The journey towards a common currency faced numerous obstacles, including weak political commitment and disagreements over economic priorities. Turbulence in international markets and geopolitical uncertainties played roles in hindering progress towards the Economic and Monetary Union.

3. International Currency Dynamics:

Post-World War II, the stability in international currency markets diminished, posing a threat to the common price system of the European Economic Community. Attempts to establish stable exchange rates were hampered by oil crises and other shocks, leading to the launch of the European Monetary System (EMS) in 1979.

4. The European Monetary System (EMS):

The EMS introduced a novel approach, using exchange rates to maintain narrow bands for participating currencies. Operated successfully for over a decade, the EMS marked a significant milestone in the coordination of monetary policies among EU countries.

5. The Delors Report:

The 'Delors Report,' under Jacques Delors' presidency, outlined a three-stage preparatory period for EMU and the euro area (1990 to 1999). European leaders accepted these recommendations, leading to the creation of the Treaty on European Union, agreed upon in Maastricht in December 1991.

6. Historic Maastricht Treaty:

The Maastricht Treaty, signed in 1991, marked a pivotal moment for the European Community, consisting of 12 member countries, including the United Kingdom, Germany, Italy, France, and others. This treaty laid the foundation for the creation of an Economic and Monetary Union (EMU) and envisioned the introduction of a single currency, the Euro.

7. Stringent Requirements for EMU Membership:

The Maastricht Treaty outlined strict criteria for countries aspiring to join the EMU and adopt the Euro. Conditions included maintaining annual budget deficits below 3% of GDP, ensuring exchange rate stability, limiting public debt to 60% of GDP, and controlling inflation rates within specified parameters.

8. Varied Debt Ratios:

Some nations, notably Italy and Belgium, faced challenges with public debt ratios exceeding the stipulated 60%, reaching as high as 120%. Despite these challenges, the European Commission endorsed their admission, acknowledging the significant efforts made by each nation to mitigate their debt ratios.

9. Enthusiasm for the Euro:

Proponents of the Euro argued that a common currency would foster economic benefits by reducing foreign exchange volatility and lowering transaction costs, ultimately stimulating cross-border trade. Despite concerns about the potential loss of national sovereignty, identity issues, and counterfeiting risks, 11 nations officially joined the EMU in 1998.

10. Launch of the Euro:

On January 1, 1999, the Euro was officially launched as an 'invisible' currency, initially utilized for accounting purposes and electronic payments. The physical introduction of Euro coins and banknotes occurred on January 1, 2002, marking the largest cash changeover in history across the EU countries.

Significance of the Euro

The Euro has played a significant role in fostering economic stability and growth within the Eurozone. By eliminating the costs associated with exchange rate fluctuations among member countries, the Euro has shielded consumers and businesses from the detrimental effects of currency fluctuations. Prior to the Euro's introduction, the need to exchange currencies imposed additional costs, risks, and transaction opacity, hindering cross-border transactions and fostering economic instability in some regions.

As the world's second most popular reserve currency, the Euro's stability and prudent economic management enhance its significance on the global stage. The currency has widespread acceptance in international trade, with almost 40% of global cross-border payments and nearly half of the EU's exports conducted in Euros. The Euro's strength and resilience also act as a stabilizing force in the face of external economic shocks, providing the Eurozone with the capacity to absorb disturbances like worldwide oil price fluctuations or disruptions in global currency markets without compromising employment and growth within the region.

Current Euro Notes & Coins

1. The Central Bank of Ireland, following Eurosystem principles, issues euro currency into circulation, ensuring an adequate supply of high-quality cash.

2. There are seven different denominations of euro banknotes: €5, €10, €20, €50, €100, €200 and €500.

3. The bank's ISO-accredited currency operations play a crucial role in maintaining the integrity, security, and quality of the euro, instilling public confidence in the currency.

4. The €50 banknote, part of the Europa Series, entered circulation on April 4, 2017.

5. Named after Europa, a figure from Greek mythology, the second series of euro banknotes showcases her portrait in both the watermark and hologram.

6. The €500 banknote, originally part of the Europa Series, ceased issuance at the end of 2018.

7. Despite discontinuation, the €500 banknote remains legal tender, and businesses are allowed to recirculate it. The Central Bank of Ireland facilitates the exchange of high-value euro currency banknotes at its public office.

8. The Europa Series of euro banknotes, the latest iteration, introduced the €100 and €200 denominations on May 28, 2019, completing the series.

10. These banknotes incorporate new and enhanced security features alongside a refreshed aesthetic, maintaining continuity with the original series while modifying the "Ages and Styles" theme depicting architectural styles from Europe's cultural history.

11. Euro coins, comprising denominations of €2, €1, 50c, 20c, 10c, 5c, 2c, and 1c, feature a common side designed by Luc Luycx of the Royal Belgian Mint, and a national side.

12. The national side varies for each member state; for instance, Ireland's euro coins retain the traditional design of the Celtic harp, a traditional symbol of the country.

13. Each country in the Eurozone also has the authority to issue two commemorative €2 coins annually. These coins celebrate historical events, significant national figures, or treasures.

How to Spot Counterfeit Euro Notes?

Authentic Euro banknotes are printed on crisp and firm cotton-based paper, providing a distinct touch. An authentic banknote paper features raised textures for the ECB initials, the gateway, and the value number. Microprinting, present on both sides of the bill, is another crucial element to inspect. Genuine Euro notes exhibit clear microprinting, and there is no sign of blurriness.

When exposed to UV light, authentic Euro banknotes reveal distinctive features. The first batch includes paper fibers of various colors, such as green, blue, and red. In the Europa series, each fiber displays three distinct hues. In direct sunlight, further features become apparent on Euro banknotes from the Europa series, including a portrait window, watermark, security thread, and a see-through number.

How Do We Measure The Value Of Euro?

The value of the Euro (EUR) against other currencies can be measured effectively using the EUR Index. This index serves as a valuable tool for assessing the relative strength or weakness of the Euro in comparison to a basket of other currencies. By tracking fluctuations in the EUR Index, analysts, traders, and policymakers can gain insights into the dynamic performance of the Euro in the forex market and make informed decisions based on the currency's changing relative value.

What is the Euro Index (EURX)?

The Euro Currency Index (EURX) is a tool that measures the value of the euro against a basket of major currencies. Here are a few key points about the Euro Index:

1. It is calculated by the European Central Bank (ECB) and is published daily.

2. The index is calculated using a geometric mean, which means that the weights of the currencies in the basket are calculated based on their trade volumes.

3. When the EUR Index rises, it indicates an increasing strength of the Euro concerning the other currencies included in the index.

4. Conversely, a declining EUR Index signals a weakening position of the Euro relative to the other currencies within the index.

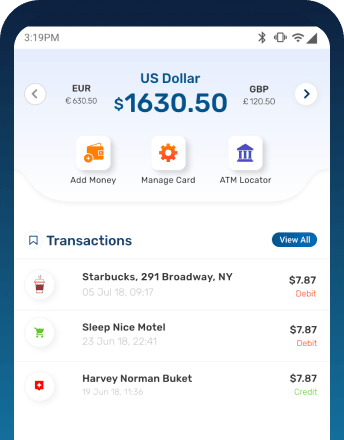

Benefits of buying/selling EUR from BookMyForex

You can buy or sell Euro online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent Euro rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling Euro:

1. BookMyForex offers the best rate for Euro to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of Euro currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%