IBAN is a globally accepted number that is used in the identification of banks abroad. It has 34 alphanumeric characters, and each represents a specific purpose in identification.

IBAN starts with a two-digit country code, two numbers that are followed by all numeric characters. IBAN does not work on the numbering system of the bank.

It is a critical piece of identification for the bank. It allows all the financial institutes to take note of the country of the bank payment, which needs to be remitted.

It acts as a method that states if the transaction, which is done is correct. IBAN lets you check the accuracy of the transactions you make internationally. It ensures that a successful transfer is made from one bank location to another.

Structure of IBAN Number

A standard IBAN has a series of characters that represent a part of the money transfer process. The format is similar for every country, the number of digits varies according to location.

Some countries use 20 characters, while some use only 15 characters. The maximum number of characters that a country can use for the IBAN is close to 34.

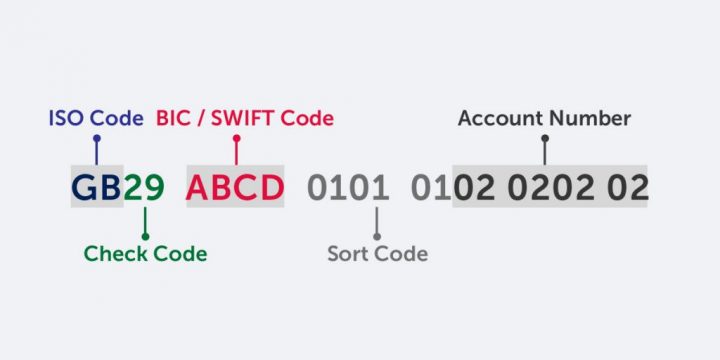

The structure of the IBAN is

Country code – The code of the place

Digit code – By initial place.

Bank identifier code – Code set up by individual banks of the place.

Branch code – Code assigned to an individual branch of the bank.

Account number – Depends on the individual.

Example:

IBAN for Austria – AT483200000012345864

IBAN for United kingdom – GB33BUKB20201555555555

As mentioned above, both the IBANs are different.

Depending on the country, the codes are decided for identification.

Historical Background

Before IBAN, there was a lot of confusion in the transfer process. The numbers, digits, and codes, every detail were to be entered by the person making an online transaction.

The routing information went missing from the payments and created more confusion. There were errors in checking digits and codes when an internal remittance was made abroad.

Routing errors caused delayed payments and were time-consuming. Some people also incurred extra costs due to delays in the payment process.

In the year 1997, the internal organization for standardization, which is also an internal standard-setting council that composes various representatives of national standard organizations developed a system for IBAN.

The process was not approved as there were many concerns raised by the European Committee for banking standards. There was a reworked version for this that required IBAN for each country to be fixed at great lengths.

They also decided that only upper case letters should be used in the characters of IBAN. In 2007, there was a revision made to this standard. When it was again split into two parts.

The various elements of the IBAN were especially used for the facilitation of data processing internationally. It was used in financial environments and data interchange. But, internal procedures were ruled out in the decisions.

The registration authority approved the IBAN, which then became the identity for internal transfers.

IBAN supports a particular format used in account identification. It contains the information that makes the process of transfer smooth.

It carries out routing information, which is needed to get the payment approved from one bank to another bank.

Standard IBAN contains the country code, branch code, and account number of the individual that is needed for remittance.

Difference between IBAN Number and SWIFT Code

Both are standardized and internationally recognized codes that are important for the international money transfer process.

A Swift Code identifies a bank when there is a transfer process, whereas an IBAN helps to identify an individual account that is associated with the bank in internal money transfer. Make sure to check & verify beneficiary swift code before sending money abroad.

Both are important for the transfer of money and play a vital role in running the internal financial market.

IBAN specifically checks whether the details of the transfer are correct. It has a two-digit country code, numbers that are followed by alphanumeric characters. The majority of European Union countries use IBAN for checking international remittances.

Majority of internal fund transfers that are made globally use the SWIFT Code. It also acts as a messaging system that allows banks to share financial data including the status of accounts, debits, and credits made.

There is a need to access both IBAN and Swift Code for international money transfers.

FAQs on IBAN Number

Q1) Where Can I Find My IBAN Number?

A1) You can find IBAN on the institution prints or the paper bank statements. You can also find it in your web-based account information if you use online banking for making payments. If you have an application, then you can log in and find your code in the statement. If you don’t find the numbers in these locations, then contact your bank for the number.

Q2) Why Do I Need an IBAN Number?

A2) IBAN is referred to as an international bank account number. The number is important to make and receive international payments. It is not a replacement for your account number, it gives a unique identity to the bank in the process of internal transfer. IBAN is an additional bank number that is utilized by banks abroad to identify your banking accounts for payments.

Q3) What does an IBAN number look like?

A3) IBAN is a unique identification account number. It has a two-letter country code and two numbers. It is followed by the characters that depend on the branch or location. There are not more than 34 characters in IBAN. The characters can be less or more depending on the code of the country. The alphanumeric characters used in IBAN are known as the basic bank account number. The IBAN includes the branch identifier number, domestic bank account number, and potential routing information, which is required for internal money transfer.

Q4) Is IBAN the same as the account number?

A4) No, both are different. The characters in use in number can distinguish an IBAN. IBAN has a standard numbering system that follows codes and characters. It does identify the individual account number for transfer but it’s not the account number itself. It is primarily used to identify the individual account that is used in the intentional transaction. IBAN verifies the method of internal transaction. An account number is a unique number dedicated to the individual from the bank.

Q5) Which countries use IBAN?

A5) Many countries in the world use IBANs for the internal transfer of money. List of countries where IBAN is mandatory are: Andorra, Austria, Bahrain, Belgium, Bosnia, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Georgia, Germany, Gibraltar, GreatBritain, Greece, Greenland, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Jordan, Kazakhstan, Kuwait, Latvia, Lebanon, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Palestine, Poland & Portugal

Q6) Is IBAN enough to transfer money?

A6) No, when you make an internal transfer, you will have to take into account the various details of the beneficiary. It includes the name of the beneficiary – the person you are sending money to. Account number or IBAN that refers to the customer’s account. IBAN helps to identify the bank accounts for internal transactions. You need Swift code, which intimates the bank about the internal remittances. You may require a national clearing code depending on the transaction and location. You will need the bank name, address, and message to the beneficiary for the transfer of money abroad.

Q7) How do I transfer money to an IBAN number?

A7) The transfer process is rather simple. You need to fill in all the banking details, which include the name of the person and bank account. This includes the account number of the recipient. The sender will have to procure the IBAN from the website or ask from the bank. Each number begins with a special country code. The designation bank will assign the next two digits. The bank identifier code and account number of the recipient will follow this. The sender has to fill in the amount in the currency used by the recipient. The process will be initiated via wire transfer.

Q8) Can I send money without IBAN?

A8) Not all banks and countries in the world use the IBAN for the transfer of money. Using IBAN to send money is indeed a convenient way to transfer. But, if there is no other option, you can use other ways to transfer. SWIFT and BIC are the two important codes that you can use while transferring money abroad. Swift Code is the most used option for internal remittances.

Leave a Reply