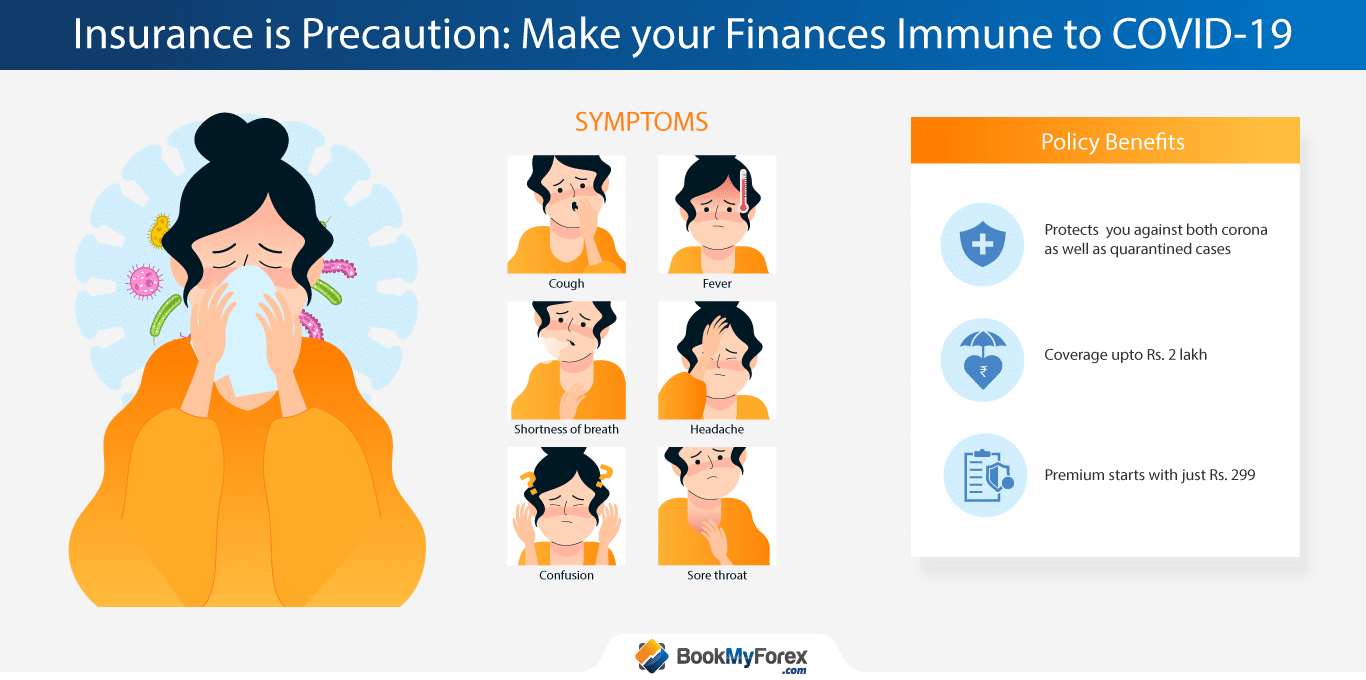

The infamous Coronavirus which originated in the Chinese city of Wuhan in December 2019 has now spread to over 50 countries of the world including parts of Asia, Europe and America. The deadly disease has claimed over 31,00 lives across the world (majorly in China) and the virus has affected about 1 lakh people. The increasing number of infected people and the fast-growing spread of coronavirus across the globe pose a great threat of it becoming a global pandemic.

The number of cases reported from India has sharply risen in recent time. India has already confirmed about 30 cases which have been found positive to Covid-2019. Therefore, it becomes very important to take all the precautionary measures by Indians to contain the spread of the virus. Apart from hygiene measures such as wearing a mask or avoiding any type of contact to infected people, getting an insurance cover against the disease can be a great financial relief.

There is a lot of ambiguity around whether your existing health cover would include protection against corona as some of the health insurance providers are extending the cover to the newfound disease on a conditional basis and some are still figuring it out. It can put you to a grave financial risk especially if you are planning to travel abroad in near future or you have just returned home from foreign travel or you find yourself having spent time with a person who has returned from a corona affected region.

While general health insurance may or may not be providing you with a cover against the Covid-2019, you can get an insurance product from BookMyForex which specifically provides insurance cover against the coronavirus. The insurance policy allows the person to get a cover upto Rs. 2 lakh by just paying up a small premium.

Benefits of Purchasing an Insurance cover against the Coronavirus

- The greatest benefit is that you get financially secured against any unfortunate event of getting exposed to or infected from the coronavirus in the near future.

- If you are tested positive for coronavirus disease (COVID-2019) after purchasing the policy, you will get 100% of the sum insured in the policy as a Lump Sum.

- In case you are advised to be quarantined in a government or a military hospital, you would get 50% of the sum assured as lump sum even when the test is later found to be negative.

Sum Insured and the Premium Requirement

The best part of the insurance policy is the coverage provided against the COVID-2019 is at a very affordable premium. The sum assured can vary from Rs. 25,000 to Rs. 2 lakh in the multiples of 25,000. You just need to pay Rs. 299 (inclusive of GST) for every Rs. 25000 as the sum insured.

| Sum Insured | Premium (Inclusive of GST) |

| Rs. 25,000 | Rs. 299 |

| Rs. 50,000 | Rs. 598 |

| Rs. 75,000 | Rs. 897 |

| Rs. 1,00,000 | Rs. 1196 |

| Rs. 1,25,000 | Rs. 1495 |

| Rs. 1,50,000 | Rs. 1770 |

| Rs. 1,75,000 | Rs. 2093 |

| Rs. 2,00,000 | Rs. 2392 |

Eligibility Criteria: Who can avail of the policy?

In order to subscribe to the insurance policy, the individual

- Must be below 75 years of age

- Must not be suffering from any respiratory-related issues such as severe cough, breathlessness etc. in the last 4 weeks

- Must not have travelled to these places such as China, Japan, Singapore, South Korea, Japan, Thailand, Malaysia, Hong Kong, Macau, Taiwan since 31st December 2019

Policy Terms

| Policy Validity | 1 Year |

| Initial Waiting Period | 15 days |

| Survival Period | 0 Days |

| Pre-Existing Disease | Not Covered |

Note: Waiting Period is the time span during which you cannot claim some or all benefits from the insurer.

How can You Purchase the Insurance policy against COVID-2019?

You can visit BookMyForex.com to get the insurance policy online or you can simply call at +91-9212219191 and our customer service executive would assist you in getting the policy and answer your queries.

Documents Required to Claim Insurance

- On Getting Quarantined: A certificate would be required from a government medical officer to start the treatment for coronavirus disease.

- If you are tested positive for COVID-19, a positive virology report from the National Insititute of Virology (Pune) would be required to claim the insurance.

Leave a Reply