Pound Sterling (GBP) Overview

The Pound Sterling (GBP) is the official currency for various regions, such as the United Kingdom, the Isle of Man, the South Sandwich Islands, Gibraltar, South Georgia, and the British Antarctic Territory. It is commonly denoted as sterling or pound, with the abbreviation being GBP. Recognized for its historical significance, the Pound Sterling holds the distinction of being the most longstanding currency in continuous circulation. It is also the fourth most frequently traded currency on the foreign exchange (forex) market, consequently, the Pound Sterling plays a pivotal role in global financial transactions.

Pound Sterling Currency Facts

| GBP Stats | GBP Profile |

| Name: | Pound sterling |

| Nickname: | Pound, Quid, Sterling |

| Symbol: | £, GBP |

| Date of Introduction: | Around 760 AD |

| GBP Currency in Circulation: | Approximately £803 billion |

| Banknotes: | Frequently Used: £5, £10, £20, £50 Rarely Used: £1, £2 |

| GBP Notes Made of: | Polymer and cotton paper blend |

| Current GBP Coins: | 1p, 2p, 5p, 10p, 20p, 50p, £1 and £2 |

| GBP Coins Made of: | Nickel-brass, cupro-nickel, and nickel-plated steel |

| Countries using GBP Currency |

United Kingdom, British Overseas Territories: South Georgia and the South Sandwich Islands, British Antarctic Territory, Crown Dependencies: Isle of Man, Jersey, Guernsey |

History of the Pound Sterling (GBP)

Pound Sterling (GBP) has a long history dating back several centuries and has undergone significant changes throughout time. Let’s take a closer look at the origin of the Pound Sterling, its evolution, and the factors that have shaped the currency:

1. Origins in 760 AD:

It is believed that the British pound was first created as currency in the year 760, making it one of the oldest legal tenders still in circulation. The name "pound sterling" draws its inspiration from the Latin word "libra," symbolizing balance and weight.

2. Introduction of Pound Coins

During the reign of Henry VII in 1489, the pound coin made its debut. Prior to this, the pound was only a unit of account, not a physical coin. This marked an early milestone in the currency's history, setting the stage for subsequent developments in coinage.

3. Mechanization and Anti-Clipping Measures:

The mechanization of coin minting in 1660 brought efficiency to the coin production process. To combat malpractices like money clipping, several features such as side lettering were introduced in coin designs, showcasing early innovations in currency security.

4. Introduction of Pound Banknotes

Pound notes entered circulation in England in 1694, shortly after the Bank of England's establishment. Interestingly, these notes were initially handwritten, reflecting the craftsmanship and manual processes of the time.

5. Decimalization in 1971:

The pound operated within a complex system of pennies and shillings until 1971 when the decimal system was introduced. This transformative shift streamlined the currency, aligning it with modern global standards.

6. Freely Floating Pound

In 1971, the United Kingdom allowed the British pound to float freely against other currencies. This change from fixed exchange rates to floating exchange rates enabled market forces to influence the pound's value dynamically.

7. Consideration of Deutsche Mark Peg and Euro Opt-Out

In 1990, there were considerations about pegging the British pound to the Deutsche Mark, but this idea was abandoned. In 2002, amidst the widespread adoption of the euro, the United Kingdom still chose to retain the pound sterling, preserving its national currency identity.

8. Current Currency Dynamics

The British pound sterling remains a dynamic and influential currency, adapting to the complexities of the current economic landscape while upholding its historical legacy. The ongoing interplay of economic forces and technological advancements continues to shape the narrative of this currency.

Significance of the Pound Sterling

The British Pound Sterling, represented by the symbol £, holds a significant position as one of the most traded currencies worldwide. Following closely behind the US dollar, Japanese yen, and euro, the GBP commands approximately 13 percent of the total daily trading volume in foreign exchange markets. This displays its crucial role in facilitating international trade and financial transactions, contributing to the interconnectedness of the global economy.

The historical legacy of the British pound further elevates its significance. Dating back to 760 AD, the GBP is recognized as the oldest actively used currency in the world. Its presence over the centuries signifies not only the stability of the currency but also its adaptability to the evolving complexities of the modern financial world. Continuously demonstrating resilience and adaptability, the British pound remains a robust economic indicator and holds a lot of significance.

Current Pound Sterling (GBP) Notes & Coins

1. The currently circulating GBP banknotes include denominations of £5, £10, £20, and £50. Denominations like £1 and £2 are rarely seen in circulation.

2. Coins come in denominations like 1, 2, 5, 10, 20, and 50 pence, as well as the 1 and 2 pounds. One pound is equal to 100 pence.

3. The Bank of England is responsible for issuing banknotes, while the Royal Mint produces coins. All UK banknotes feature the portrait of Queen Elizabeth II.

4. Banknotes were originally handwritten until the Bank of England began printing them in 1855.

5. The design of the notes has evolved significantly over time, incorporating new security features and reflecting changing cultural trends.

6. Both notes and coins are designed with security features to deter counterfeiting. They are made from a unique blend of materials that are difficult to replicate.

7. The value of the pound sterling has fluctuated significantly throughout history, but it remains one of the world's most stable and widely used currencies.

How to Spot Counterfeit Pound Sterling Notes?

To make sure a British Pound (GBP) note is real, you can do a few simple things. First, run your finger over the words "Bank of England" on the front – a real note will have a raised print that you can feel. Moreover, the micro lettering should spell out the note's value in words and numbers. Check the lines and colors for sharpness; if they are blurry or smudged, they might be fake.

Also, you will find the silver foil patches on the note – one at the top where the crown should appear in 3D and one at the bottom that changes from "Value" to "Pounds" when tilted. New notes have a see-through window. You will be able to see the Queen and "Bank of England" twice, with a gold image on the front and a silver one on the back showing a rainbow effect when tilted. Checking all these things will help you make sure your GBP notes are real and not fake.

How Do We Measure The Value Of GBP?

The value of GBP is measured using a GBP Index. It essentially operates as a comparative measure, assessing the pound against a basket of currencies. This basket typically includes significant currencies from major regions, thereby providing a comprehensive overview of the pound's performance.

What Is the Pound Sterling Index (GBPX)?

The GBP Index, also known as the Sterling Index, is a weighted average of the value of the pound sterling against a basket of other major currencies. Here are a few key points about the Sterling index:

1. The GBPX is calculated based on the weighted average of the value of the pound against six major currencies namely the Euro (EUR), US Dollar (USD), Japanese Yen (JPY), Swiss Franc (CHF), Canadian Dollar (CAD) and Australian Dollar (AUD).

2. The weights assigned to each currency reflect their relative importance in international trade, with the euro holding the highest weight due to the size of the European Union's economy.

3. A rising GBP Index signals a strengthened pound when measured against the basket of currencies. This uptrend implies that the pound has gained value in comparison to its counterparts.

4. Conversely, a declining index suggests a weakened pound in relation to the basket, indicating a decrease in its value on the global stage.

5. Note that the GBPX only measures the pound's performance against a specific set of currencies, neglecting other potentially influential factors.

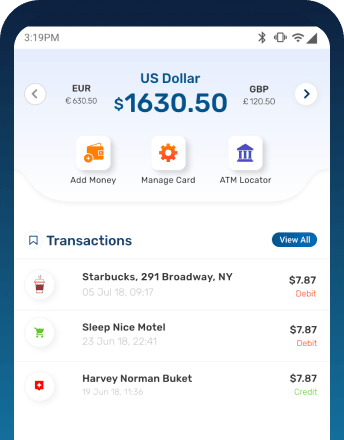

Benefits of buying/selling GBP from BookMyForex

You can buy or sell GBP online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent GBP rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling GBP :

1. BookMyForex offers the best rate for GBP to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of GBP currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%