The US dollar serves as the world’s most dominant currency. Regarded as the benchmark currency, the US dollar determines the value of other currencies in the universal market. The US dollar is also one of the most commonly used currencies in international investment and trade. Trading with the dollar is much easier than any other currency.

The emergence of the dollar as an indispensable medium of exchange began after World War I placed restrictions on exchanges. Since then, the dollar has been enjoying worldwide attention. In light of this, the Indian currency, like various others, is compared against the dollar to determine its value.

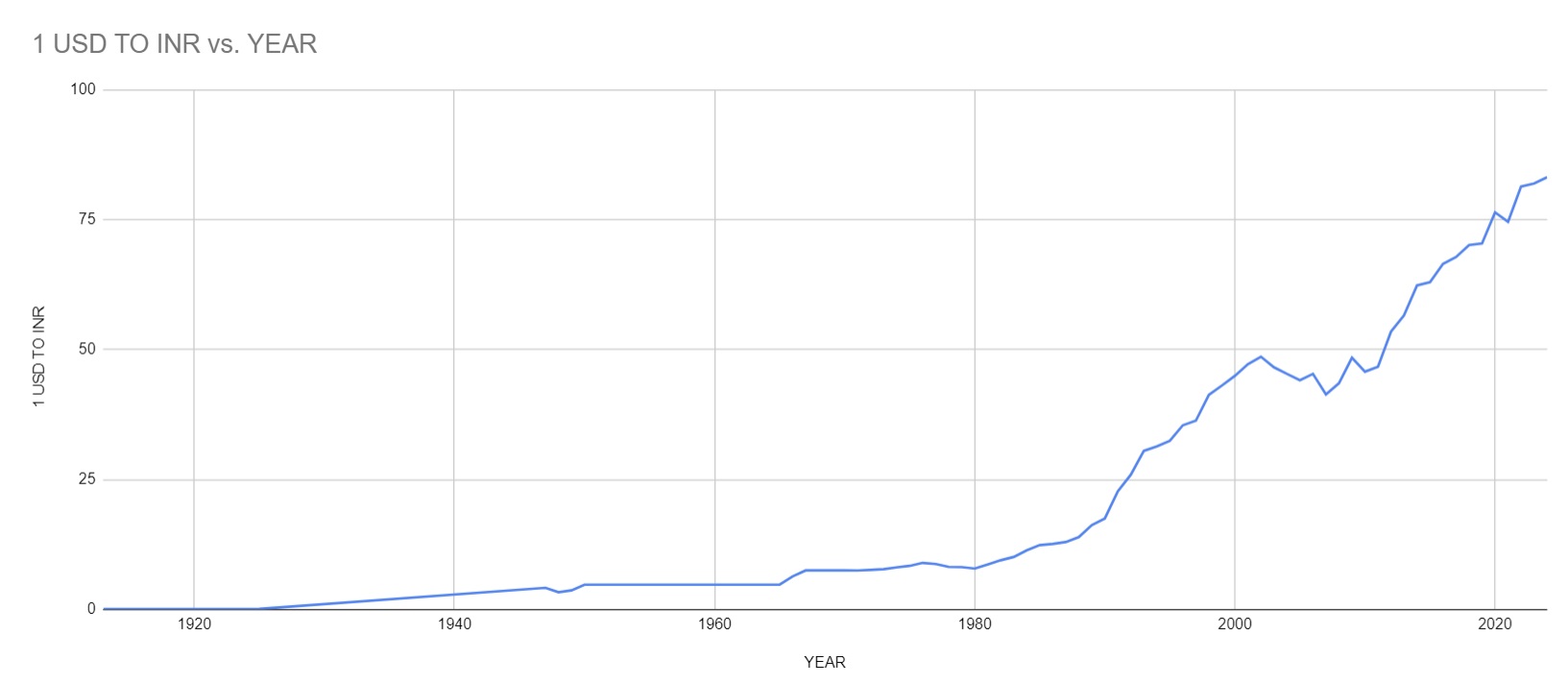

The historical exchange rates of 1 USD to INR (Indian Rupee) from 1947 until now have seen significant changes due to various economic policies, global events, and market forces. In this blog, we’re taking a trip down memory lane to see how the exchange rate between the US dollar (USD) and the Indian rupee (INR) has changed since India’s independence in 1947.

How the Value of 1 USD to INR Has Changed From 1947 to 2024?

The 1 USD to INR exchange rate has always had extreme volatility since its inception and has seen a lot of fluctuations over the years. We have brought you 1 USD to INR values table ranging from 1947 till date so that you can see the change in INR’s value.

| YEAR | Value of 1 US Dollar in Indian Rupee | YEAR | Value of 1 US Dollar in Indian Rupee | YEAR | Value of 1 US Dollar in Indian Rupee |

|---|---|---|---|---|---|

| 1913 | 0.09 | 1972 | 7.59 | 1999 | 43.06 |

| 1925 | 0.1 | 1973 | 7.74 | 2000 | 44.94 |

| 1947 | 3.3 | 1974 | 8.1 | 2001 | 47.19 |

| 1948 | 3.31 | 1975 | 8.38 | 2002 | 48.61 |

| 1949 | 3.67 | 1976 | 8.96 | 2003 | 46.58 |

| 1950 | 4.76 | 1977 | 8.74 | 2004 | 45.32 |

| 1951 | 4.76 | 1978 | 8.19 | 2005 | 44.1 |

| 1952 | 4.76 | 1979 | 8.13 | 2006 | 45.31 |

| 1953 | 4.76 | 1980 | 7.86 | 2007 | 41.35 |

| 1954 | 4.76 | 1981 | 8.66 | 2008 | 43.51 |

| 1955 | 4.76 | 1982 | 9.46 | 2009 | 48.41 |

| 1956 | 4.76 | 1983 | 10.1 | 2010 | 45.73 |

| 1957 | 4.76 | 1984 | 11.36 | 2011 | 46.67 |

| 1958 | 4.76 | 1985 | 12.37 | 2012 | 53.44 |

| 1959 | 4.76 | 1986 | 12.61 | 2013 | 56.57 |

| 1960 | 4.76 | 1987 | 12.96 | 2014 | 62.33 |

| 1961 | 4.76 | 1988 | 13.92 | 2015 | 62.97 |

| 1962 | 4.76 | 1989 | 16.23 | 2016 | 66.46 |

| 1963 | 4.76 | 1990 | 17.5 | 2017 | 67.79 |

| 1964 | 4.76 | 1991 | 22.74 | 2018 | 70.09 |

| 1965 | 4.76 | 1992 | 25.92 | 2019 | 70.39 |

| 1966 | 6.36 | 1993 | 30.49 | 2020 | 76.38 |

| 1967 | 7.5 | 1994 | 31.37 | 2021 | 74.57 |

| 1968 | 7.5 | 1995 | 32.43 | 2022 | 81.35 |

| 1969 | 7.5 | 1996 | 35.43 | 2023 | 81.94 |

| 1970 | 7.5 | 1997 | 36.31 | 2024 | 84.83 |

| 1971 | 7.5 | 1998 | 41.26 |

What Was the Value of 1 USD to INR in 1947?

Now there’s some debate about the exact exchange rate in 1947. Some sources suggest it might have been close to 1 USD = 1 INR. Honestly, it is nothing more than a myth. If you are thinking that exchanging 1 USD for INR in 1947 would have got you 1 Rupee exactly, then, sadly, that’s not true. ‘Why‘ do you ask? Here’s the answer:

1. When India gained independence in 1947, the Indian Rupee was not pegged to the US Dollar, and there was no balance sheet parity to support a 1:1 exchange rate. Additionally, prior to independence, India was under British rule, and the Indian Rupee was pegged to the British Pound.

2. From 1927 to 1966, 1 British Pound was valued at 13 INR, and this fixed exchange rate remained in place until 1966 when India experienced its first major devaluation. Therefore, after independence, the Indian Rupee continued to peg to the British Pound at a rate of 1 Rupee = 1 Shilling and 6 Pence, equivalent to 13 1/3 INR per British Pound.

3. At that time, the British Pound was valued at approximately 4 USD, which means that the actual value of 1 USD in 1947 would have been around 3.30 INR — not 1 INR.

Note: India became a republic nation in 1950. The constitution of India came into existence in 1952. At that time 1 USD was equal to 4.766 INR or 1 USD =4.76 NCU. (NCU is National Currency Unit)

Also Read: USD To INR currency conversion: How to avoid a common travel blunder

Factors Contributing to the Devaluation of the Indian Rupee Against the US Dollar

Now the real question is–why has the value of the Indian rupee changed so much since 1947 to date? Well, our forex experts have come up with a detailed answer.

1. Pre-Independence Era — Before 1947

During the pre-independence era, India was under British colonial rule, which significantly impacted its economy, including the value of its currency. As a result, the value of the rupee was closely tied to the economic conditions in Britain.

Like many global currencies at the time, the British Pound was convertible to USD within a one percent margin of fixed rates, while the US dollar was pegged to gold, as determined by the Bretton Woods Agreement. The Great Depression of the 1930s devastated the global economy, and India, as a British colony, suffered doubly.

2. India’s Independence — 1947

Indian currency began to be measured against the US dollar in 1947 after India gained its independence. The value of 1 INR then could be taken as 1 USD, considering that the national balance sheet was free from any credit or debit.

However, the value of Indian currency was derived from the British pound. The British Pound was valued at approximately 4 USD, and hence the value of the Indian Rupee back in 1947 was around 3.30, considering 1 Rupee = 1 Shilling and 6 Pence, equivalent to 13 1/3 INR per British Pound.

Simply put, the British pound served as the basis for the value of Indian currency, it played a role in the depreciation of the rupee. However, this pricing of the rupee versus the British pound persisted because there was no accepted method of currency comparison until 1944.

3. Post-Independence Era — 1950 to Early 1990s

The Indian Rupee maintained a value of ₹4.76 against the US dollar from 1950 until 1966. However, India’s economic standing began to decline due to its weakened credit reputation in global markets. Contributing factors included the 1962 India-China war, the 1965 India-Pakistan war, and the severe drought of 1966, which ultimately devalued the rupee to ₹7.50 per dollar by 1967.

The rupee faced further challenges in 1974, falling to ₹8.10 per dollar due to the 1973 oil crisis when OAPEC (Organisation of Arab Petroleum Exporting Countries) reduced oil production. India had to borrow foreign currency to manage the crisis, leading to political and economic instability that further eroded the rupee’s value. Throughout the 1980s, the rupee continued to weaken, and by the early 1990s, it had dropped to ₹17.50 per dollar.

4. Pre-21st Century Era — 1990s to 2000

India’s economy went through a tough time in the 1990s. Interest payments accounted for 39% of the revenue that the government collected at the time. The fiscal deficit was reduced to 7.8% of GDP, and India was on the verge of being declared a defaulter in the international market. Furthermore, the devaluation changed the exchange rate from 1 USD to 25.92 INR in 1992. The Indian currency value kept falling since then!

To overcome this, the Indian government initiated economic liberalization policies in the 1990s which started bearing fruit. Increased foreign investment and a growing Information Technology (IT) sector boosted India’s foreign exchange reserves. This kept the rupee value somewhat stable and even gained strength for a brief period in the early 2000s.

5. 21st Century — 2001 to 2024

Starting at roughly ₹47 per USD in 2001, the rupee depreciated to around ₹75 twenty years later. India’s economic growth during this period led to increased demand for imports which resulted in a current account deficit, where the value of imports exceeded the value of exports. To overcome this, the RBI had to sell foreign exchange reserves, which put downward pressure on the rupee. Other global events like the 2008 financial crisis also had a significant adverse impact on the value of the Indian Rupee.

The depreciation of the Indian Rupee (INR) against the US Dollar (USD) continued from 2020 to 2023, with the exchange rate reaching around ₹83 per USD in 2023. This continued depreciation can be attributed to several factors, including the COVID-19 pandemic and geopolitical tensions.

The Indian Rupee (INR) has continued to weaken against the US Dollar (USD) from 2021 to 2024. The gap between India’s imports and exports remains a concern. The high cost of oil imports and strong global demand for certain Indian exports haven’t been enough to offset the deficit. This increased demand for foreign currency to pay for imports continues to put pressure on the rupee.

USD to INR Exchange Rate Monthly Analysis — December 2024

The first few days of December 2024 saw a continuation of the rupee’s depreciation trend, with the INR hovering around ₹84.50. By mid-December, the exchange rate climbed further due to persistent foreign fund outflows and a strengthening US dollar, reaching a peak of ₹84.80. The rupee’s decline can be attributed to factors such as high crude oil prices, foreign fund outflows, US federal interest rate hikes, and a widening current account deficit.

USD to INR Rates in December 2024:

1. The highest exchange rate is ₹84.83.

2. The average exchange rate in 2024 is ₹84.58.

3. The lowest exchange rate is ₹84.45.

Check out here for next 12 month USD to INR Forecast

General Factors Affecting USD-INR Exchange Rates

A fluctuating exchange rate between INR and USD is not something new. Currency values fluctuate every day, and so does the value of the rupee in relation to the US dollar. Numerous factors have influenced the USD-INR exchange rate over the years. Five such factors are listed below.

1. INR-USD exchange rates are affected by the inflation rate in India and USA.

2. The interest rate is another important factor in determining INR-USD exchange rates.

3. Exchange rates are influenced by government debt as well.

4. Terms of trade are the next factor to consider. It is defined by the ratio of the index of a country’s export prices to the index of its import prices.

5. Last but not least, the INR-USD rate is also affected by the political stability in both India and the United States.

Leave a Reply