Introduction:

The Canadian dollar is the official currency of Canada. The symbol is $ and the currency code is CAD. Since a lot of countries’ currency is called Dollar, and in order to differentiate it from those currencies, it is written as Can$ or C$. It is the fifth most-held reserve currency in the world after USD, EURO, Yen, and GBP.

The Indian Rupee (INR) is the official currency of India. It is interesting to note that 4% of the Canadian population identifies themselves as Indians. This number is huge, indicating a lot of people movement happening between Canada and India. Because of this flow, the conversion of CAD to INR is significantly high, even on par with pounds and dollars.

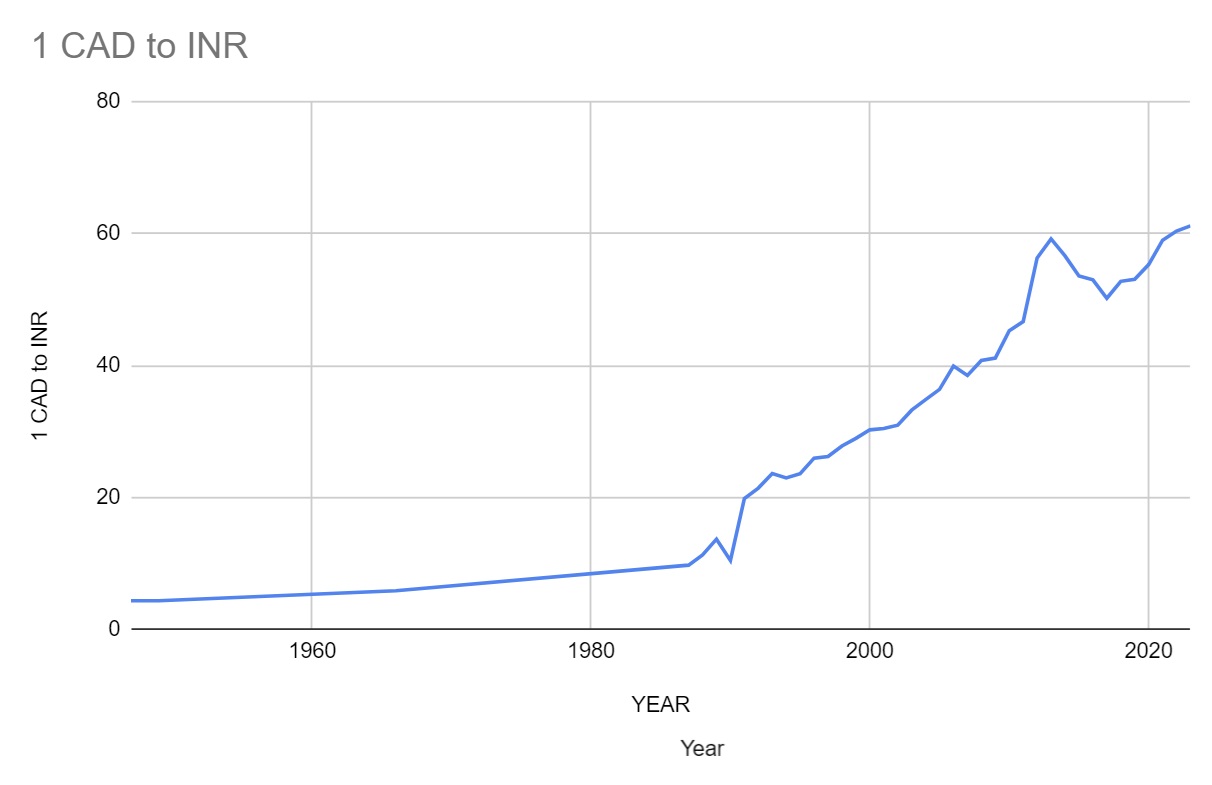

Over the years, the CAD to INR rate has experienced both highs and lows, influenced by various factors such as economic indicators, monetary policies, geopolitical events, and market sentiment.

Value of 1 CAD to INR from 1947 to date

Given below is a table listing the value of 1 CAD in relation to INR from 1947 till date.

| YEAR | 1 CAD to INR | YEAR | 1 CAD to INR |

|---|---|---|---|

| 1947 | 4.37 | 2004 | 34.83 |

| 1949 | 4.37 | 2005 | 36.39 |

| 1966 | 5.9 | 2006 | 39.93 |

| 1987 | 9.77 | 2007 | 38.49 |

| 1988 | 11.30 | 2008 | 40.77 |

| 1989 | 13.70 | 2009 | 41.12 |

| 1990 | 10.49 | 2010 | 45.28 |

| 1991 | 19.85 | 2011 | 46.66 |

| 1992 | 21.44 | 2012 | 56.29 |

| 1993 | 23.63 | 2013 | 59.17 |

| 1994 | 22.97 | 2014 | 56.60 |

| 1995 | 23.62 | 2015 | 53.57 |

| 1996 | 25.98 | 2016 | 52.97 |

| 1997 | 26.22 | 2017 | 50.19 |

| 1998 | 27.81 | 2018 | 52.75 |

| 1999 | 28.97 | 2019 | 53.06 |

| 2000 | 30.26 | 2020 | 55.29 |

| 2001 | 30.46 | 2021 | 58.98 |

| 2002 | 30.97 | 2022 | 60.37 |

| 2003 | 33.24 | 2023 | 61.15 |

Historical Events That Noticeably Impacted CAD to INR Rate

The CAD to INR exchange rate has been subject to various historical events that have significantly influenced its value. These events have had a direct impact on the Canadian dollar (CAD) and the Indian rupee (INR), shaping their exchange rate dynamics.

-

Indian Rupee Devaluation (1966)

In 1966, the Indian government made the decision to devalue the rupee by 57% against the US dollar. This strategy aimed to bolster exports and enhance the nation’s balance of payments. Consequently, this devaluation had a direct impact on the exchange rate between the Canadian dollar (CAD) and Indian Rupee (INR). The INR experienced a depreciation against CAD, leading to an increase in exchange rates from approximately 4.37 to 5.90.

-

Oil Crisis (1973)

The 1973 oil crisis was a major turning point within the global financial system. It happened because of a combination of factors, including the Arab-Israeli War, the OPEC oil embargo, and the increasing demand for oil from industrialized nations.

The oil embargo became a chief factor in the crisis and caused a sharp increase in oil costs. The charge of oil quadrupled from $3 per barrel in 1973 to $12 in step with barrel in 1974. The increase in oil expenses had a big effect on the global economy, leading to a recession in many countries.

The Canadians were particularly hit by means of this oil crisis. This is because the Canadian financial system is intently tied to the oil marketplace. Canada is a main oil producer and exporter, and the oil sector performs a key function in the Canadian economy. The oil disaster brought a depreciation in the Canadian dollar against different currencies including INR.

-

Introduction of Floating Exchange Rate Regime (1975)

In 1975, India shifted from a fixed exchange rate regime, where the Indian Rupee was pegged to the British Pound Sterling, to a floating exchange rate regime. This transition had repercussions on the CAD to INR rate. The move to a floating regime made the exchange rate more susceptible to market forces, causing rate fluctuations. This shift resulted in a depreciation of INR against the CAD.

-

Indian Economic Reforms (1980s)

The Indian government started out enforcing a chain of financial reforms in the eighties. These reforms were carried out for the purpose of liberalization, privatization, and deregulation. The reforms led to a period of economic growth in India, which helped to strengthen the Indian rupee towards the Canadian dollar.

-

Indian Rupee Crisis (1991)

In 1991, India suffered a severe financial crisis. The nation’s foreign exchange reserves had been depleted, and the rupee was facing downfall. The Indian authorities had no other option but to devalue the rupee by 18% against the USD. The devaluation also had an impact on the CAD to INR rate, which increased from 10.49 to 19.85 during this crisis.

-

Asian Financial Crisis (1997)

The 1997 Asian financial crisis was a major economic event that affected many Asian nations. The nations had massive current account deficits, which meant that they had been importing more items than they were exporting. This caused a loss of foreign exchange reserves. The crisis brought about the depreciation of Asian currencies against other currencies. The Indian rupee depreciated towards the Canadian dollar at this time.

-

Global Financial Crisis (2008)

The 2008 global financial crisis turned into the worst economic crisis ever and led to the depreciation of many currencies, including the Canadian dollar and the Indian rupee. The CAD to INR rate became impacted by the crisis, and the Indian rupee depreciated by around 6% towards the Canadian currency during this period.

-

European Debt Crisis (2010)

The European debt crisis started out in 2010 after it was found out that Greece had been understating its budget deficit for years. This caused the investor’s lack of confidence in the euro and different European currencies.

The crisis left an impact on the global financial system, including the CAD to INR exchange rate. The Canadian currency was seen as a safe haven, so investors bought Canadian dollars all through the crisis. This brought about an appreciation of the CAD in opposition to the Indian rupee.

-

GDP Growth (2017)

In 2017, India’s GDP witnessed robust growth at 7.1%, outpacing major global economies. This strong economic growth led to increased demand for the Indian rupee, which supported its appreciation. Additionally, the Indian government announced a number of reforms in 2017, including the Goods and Services Tax (GST), which was seen as a positive aspect of the Indian economy. These combined factors influenced the strengthening of the INR against the CAD in 2017.

-

COVID-19 Pandemic (2020)

The COVID-19 pandemic had far-reaching consequences on the global economy. It led to economic slowdowns, rising unemployment, and, consequently, negative impacts on both the Canadian Dollar and the Indian Rupee. The CAD to INR exchange rate witnessed a sharp increase, rising from 55.29 to 58.98 in the aftermath of the pandemic.

-

Russia-Ukraine War (2022-2023)

The Russia-Ukraine war has had an impact on the economy worldwide. The war has caused a sharp increase in electricity and food prices, which has caused inflation in many countries. The war has had a bad effect on both the Canadian dollar and the Indian rupee. The CAD to INR exchange rate has ranged between 60.37 and 61.15 in 2022-2023.

Currency Dynamics between EUR and INR

The currency dynamics between CAD and INR has implications for various stakeholders. For Canadian businesses exporting goods or services to India, a strong CAD to INR exchange rate can make their products more expensive for Indian buyers, potentially reducing demand. Conversely, a weak CAD to INR rate can make Canadian products more affordable and attractive to Indian consumers.

Similarly, for Indian businesses exporting to Canada, a strong CAD to INR rate can make their products more competitive in the Canadian market. Conversely, a weak CAD to INR rate can reduce their competitiveness.

Individuals who travel between Canada and India also need to consider the CAD to INR exchange rate when exchanging currency. A favorable rate can allow them to get more Indian Rupees for their Canadian Dollars, making their travel expenses more affordable.

Note that the CAD to INR exchange rate is influenced by various external factors, including global economic trends, political events, and market speculation. These factors can cause significant fluctuations in the exchange rate, making it challenging to predict and manage currency risk effectively.

Leave a Reply